Beverage Media Group Publications

About

Beverage Media’s local trade publications have served as the alcohol industry bible since 1936, offering the “local advantage” that wholesale buyers, distributors, and suppliers have relied on for decades. Our network of national, market-specific publications is a proven channel for staying up to date with insights you can trust and distributor pricing by region.

SevenFifty Daily and Beverage Media Group (BMG) joined forces in 2019 as sister publications, extending their collective reach across the beverage alcohol industry. Together, we bring unprecedented access to the nation’s largest beverage alcohol trade audience, with innovative technology solutions that power the three-tier system. Collectively, our widely-read trade publications—the award-winning online magazine SevenFifty Daily and Beverage Media Group’s iconic print publications—foster a deeply-connected trade community and comprise the most essential advertising platform for reaching retail and restaurant buyers.

Beverage Media is a Provi publication. Learn more about Provi, an online marketplace for wholesale alcohol, and SevenFifty Daily, BMG’s sister publication.

Advertise With Us

Circulation: 41,000+ buyers

Learn more about market-specific advertising that targets your key customers, and ask about our bundled advertising packages that help you reach your audience across multiple print and digital channels. Request info

Subscriptions

Our network of local publications.

Get the “local advantage” that wholesale buyers, distributors, and suppliers have relied on for decades by subscribing to your market’s monthly publication.

New York and New Jersey

California

- California Beverage Industry News

Connecticut

- Connecticut Beverage Journal

Florida

Hawaii

- Hawaii Beverage Guide

Maryland

- Maryland Beverage Journal

Massachusetts

- Massachusetts Beverage Business

Pennsylvania

Rhode Island

- Rhode Island Beverage Journal

Washington DC

- Washington DC Beverage Journal

Digital Archives

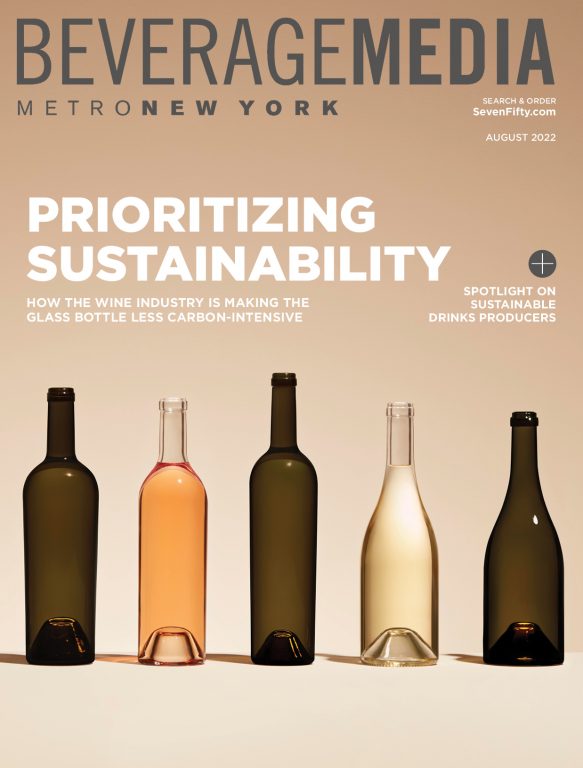

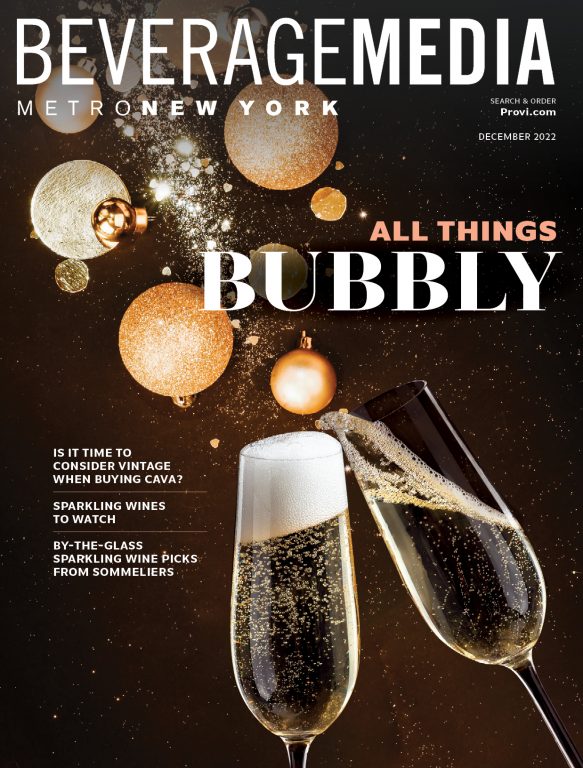

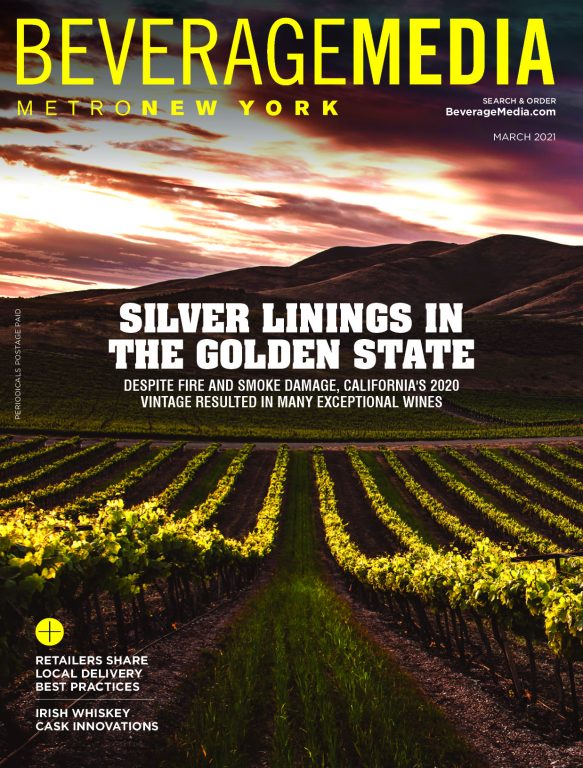

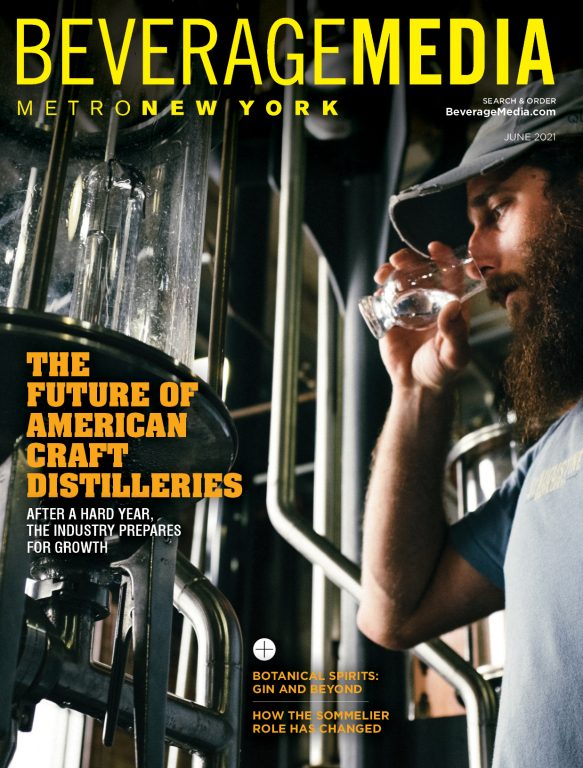

See the latest issue of New York Beverage Media – Metro edition for the latest features, insights and local news within the beverage alcohol industry.

2024

2023

2022

2021

Contact

Editorial

For questions, comments, pitches, or corrections

editor@sevenfifty.com

Subscriptions

For subscriptions, renewals, or billing

beveragemedia@provi.com

Advertising

For advertising inquiries

ads-daily@sevenfifty.com